Trading Psychology: Emotional Factors Deciding Success or Failure in Trading

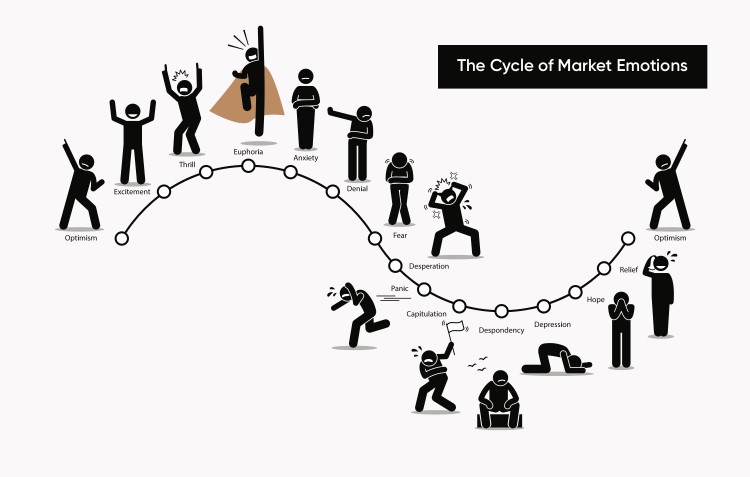

In financial trading, psychology plays an important role in decision making. Traders not only have to face market fluctuations, but they also have to control their emotions to make wise decisions. Here's an in-depth look at trading psychology, the main emotions that affect traders, and how to manage them.

|

| Investor's trading psychology |

What is Trading Psychology?

Trading psychology refers to the psychological factors that influence how people trade in markets such as cryptocurrencies or stocks. Emotions can significantly impact a trader's decision-making process. For example, greed can cause traders to make high-risk decisions, while fear can lead to panic selling.

Two Primary Emotions: Fear and Greed Scared:

Avoid risks: Fear makes traders avoid all risks and may miss out on profitable trading opportunities.

Panic: When the market drops sharply, fear can lead to selling off assets to avoid further losses.

Greed:

High Risk: Greed drives traders to take high risks to maximize profits, such as buying assets at their peak because the price is rising rapidly.

Mindless Decisions: Greed can cause traders to ignore rational analysis and make decisions based on emotions.

FOMO - Fear of Missing Out Syndrome

FOMO is especially common when an asset increases in value significantly in a short period of time. Many traders base their market decisions on emotions rather than logic and reason, leading to irrational trading decisions.

|

| FOMO - Fear of Missing Out Syndrome |

Why Is Understanding Psychology Important?

Understanding and controlling your emotions helps traders make wise decisions and minimize losses. Experienced traders know how to balance fear and greed, protect themselves from unnecessary risks and take advantage of opportunities.

Psychological Challenges in Trading

Unrealistic Expectations:

Trading is not a way to get rich quickly. People who trade with this idea often encounter failure.

Losses:

Losing trades often have a hard time accepting losing trades and can lead to attempts to recoup losses with more capital, causing further losses.

Win:

Winning feels good but can lead to overconfidence and riskier decisions.

Market Psychology and Social Networks:

New traders are easily influenced by negative or positive sentiment on social networks, leading to irrational trading decisions.

How to Use Trading Psychology to Become a Better Trader

|

| When the mind is calm, everything is peaceful |

Think Long Term:

Rest for a while:

Learn From Mistakes:

Set Up Rules:

Summary

CONTACT US

If you have any questions or concerns, please contact us via the following information:

- Email address: propfirmchannel@gmail.com

- Điện thoại: +84925.012.777 - +8429.9999.3333

Facebook X Tiktok

Post a Comment